Learn About The Plastics Treaty ➝

Protect our planet! Last chance to join the call for a strong Plastics Treaty. SIGN THE PETITION NOW.

In 2022, governments agreed to UNEP Resolution 5/14 recommending developing an international legally binding instrument (ILBI) aimed at addressing plastic pollution across its life cycle. Several studies have published estimates to visualise the scale of the problem, with the Nordic Council of Ministers (2023) projecting mismanaged plastic to nearly double to 205 MT by 2040, from 110 MT in 2019, under a business-as-usual scenario. OECD (2022), meanwhile, warns that plastic waste generation is expected to triple by 2060. The treaty should incentivize financial flows away from plastic production and towards activities like reuse, product design, and improved recycling and waste management.

Substantial investment is necessary to address plastic pollution. UNEP Finance Initiative (2023) estimates that interventions focused on system change and single-use plastic reduction could cost USD 1.64 trillion. Developing countries, meanwhile, face a significant financing gap of up to USD 500 billion, for implementing safe waste management infrastructure, supporting reuse models, ensuring a just transition for informal workers, cleaning up legacy plastic waste, and addressing human health impacts (Minderoo Foundation 2023).

The Intergovernmental Negotiating Committee, through the ad hoc intersessional open-ended expert group, has identified financing mechanisms (2024) such as a proposed plastic pollution fee, credit schemes, and EPR systems.

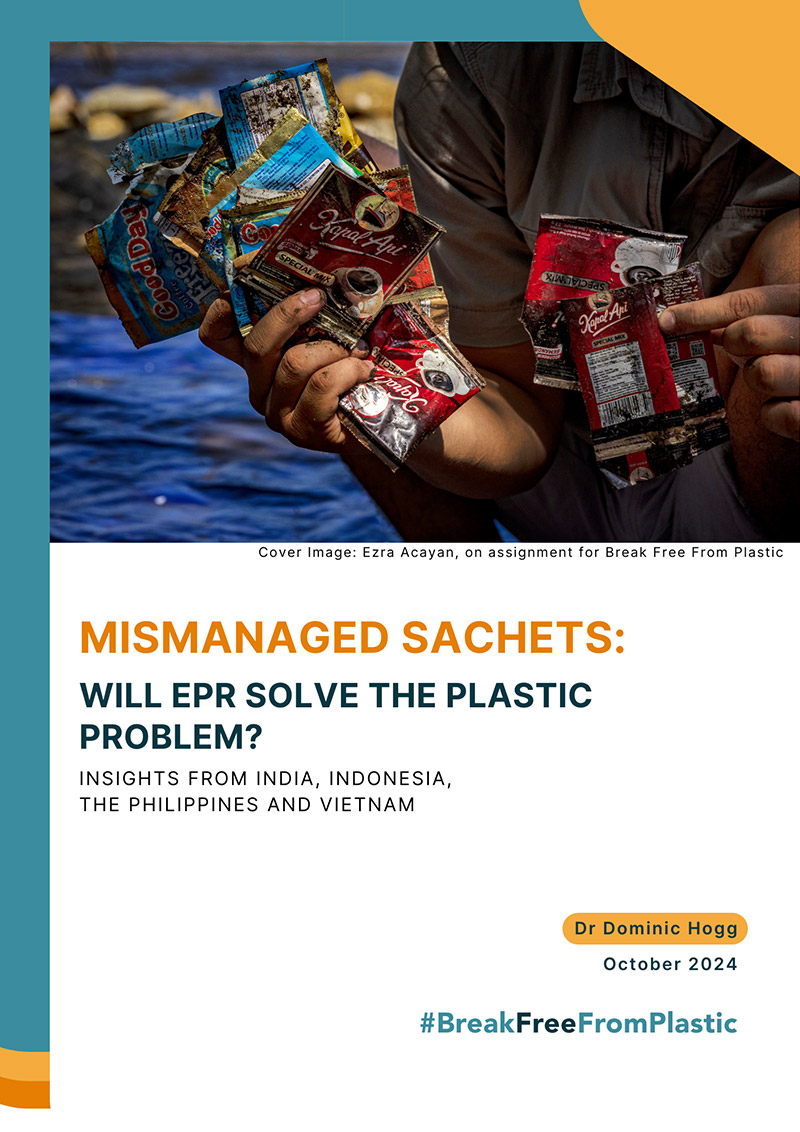

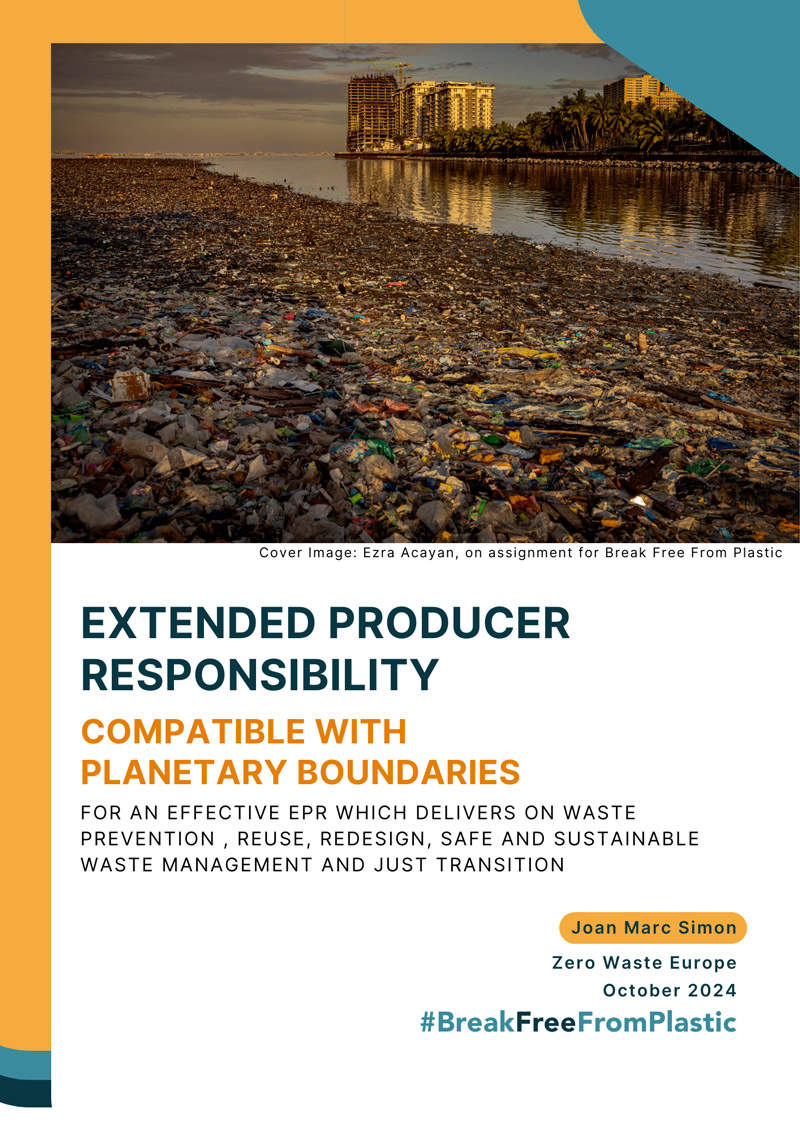

All photos used on this page were shot by Ezra Acayan on assignment for Break Free From Plastic.

Policies play a vital role in accelerating the adoption of such plastic solutions. While governments and businesses recognize how reuse and refill solutions can prevent plastic pollution and contribute to plastic production reduction, enabling policies are still lacking at national and global levels. The webinar examines promising policies that enable and drive investment to the right kind of solutions.

This panel discussion is organised by the Center of Science and Environment and Break Free From Plastic as part of the Plastic Parleys webinar series. It serves as a curtain-raiser to the Fifth INC Session, scheduled for November in Busan, South Korea.

13 November 2024

15:00 - 16:30 India

16:30 - 18:00 Jakarta

17:30 - 19:00 Manila

This panel discussion is organized by the Center of Science and Environment and Break Free From Plastic as part of the Plastic Parleys webinar series. It aims to:

KEY HIGHLIGHTS: